Green Shift Completes Initial Sampling Program at the Armstrong Lithium Project in Ontario

Toronto, Ontario – January 9, 2024 – Green Shift Commodities Ltd. (TSXV: GCOM and OTCQB: GRCMF), (“Green Shift”, “GCOM” or the “Company”) is pleased to announce that initial exploration work on its Armstrong Lithium Project (the “Armstrong Project” or the “Project”) is now complete. The sampling program consisted of reconnaissance prospecting and geological mapping along the 90 contiguous claims totaling ~1,800 ha, located in the Seymour-Crescent-Falcon lithium belt, ~55 km northeast of the town of Armstrong and ~245 km from Thunder Bay in Ontario, Canada.

Highlights

- Given the potential of the region, the purpose of the program was to identify lithium bearing structures resembling the adjacent properties held by Green Technology Metals Limited (“GT1”) and Antler Gold Inc. (“Antler”).

- Mapping and sampling done which indicate several positive mineral occurrences leading to further planned exploration.

- 2023 prospecting program yielded several highly anomalous results in both lithium (Li) and tantalum (Ta), with notable samples including:

- Sample 1290089 223 ppm Li

- Sample 1290018 175 ppm Li

- Sample 1290064 98 ppm Ta

- Sample 1290066 greater than 100 ppm Ta

All results of the samples are listed in Table 1 below.

- The results of the samples were above the crustal average for all four elements tested, supporting GCOM’s thesis that the Project’s pegmatites are sourced from a peraluminous granite melt and, in a region, prospective for Li bearing pegmatites.

- The results are currently being used to plan further exploration work in 2024.

Peter Mullens, Executive Chairman of GCOM commented, “We are excited to advance the Armstrong Project with initial exploration. Sampling has shown the presence of potential lithium bearing pegmatites with a peraluminous granite source, which resembles closely the highly prospective neighbouring properties held by GT1 and Antler. With these findings, we can now start planning our 2024 work program. Ontario is an exciting place to be, in particular for lithium, with the province seeing ~$25B in government subsidies for EV battery plants in 2023 alone, and this being a very low-cost entry into the most prospective lithium exploration belt in the province.”

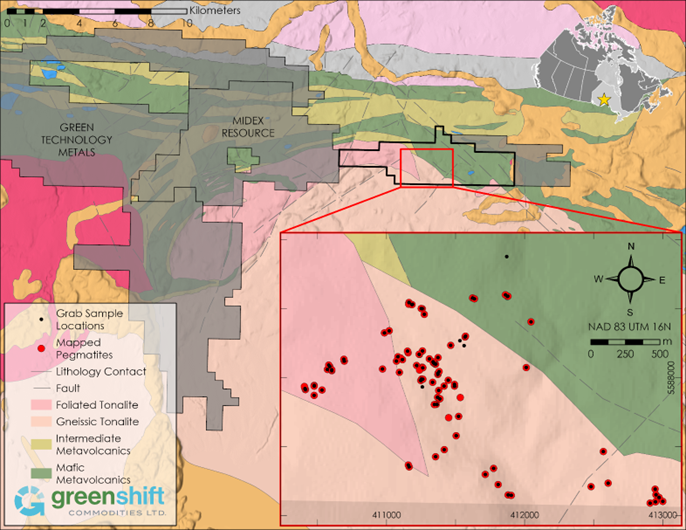

Figure 1 – 2023 Sampling Program at the Armstrong Project in Northern Ontario

2023 Sampling Program

The 2023 sampling program consisted of reconnaissance prospecting and geological mapping conducted by Fladgate Exploration Consulting Corporation, a full-service mineral exploration consulting group.

A total of 287 mapped features and 89 samples were collected on the Project with results from rock chip sampling and prospecting showing above average crustal levels for 17 out of 89 samples for the following four elements: Li (20 ppm), Cs (4 ppm), Rb (112 ppm) and Ta (2 ppm). In addition, the mean for all of the samples is above the crustal averages for all four elements supporting the model that the Armstrong Project pegmatites are sourced from a peraluminous granite melt and, in a region, prospective for Li bearing pegmatites. While the overall grade of these samples is low, it is indicative of the potential presence of spodumene bearing pegmatites, related to a peraluminous granite melt. Relevant analytical results of the samples are listed in Table 1 and include lithium, cesium (Cs), rubidium (Rb) and tantalum.

The primary focus of the 2023 exploration program was to define and better understand the lithium bearing pegmatite placement on the Project in order to develop targets for future exploration programs. Samples were chosen based on visual observations of pegmatites with favourable Li-bearing mineralization, beryl, muscovite, tourmaline. The collection sites of the prospecting samples and lithology mapping are illustrated in Figure 1.

Additionally, geochemical analysis of the samples shows a positive A/CNK ratio. The A/CNK molecular ratio [Al2O3/(CaO + Na2O + K2O)] which is commonly used to indicate whether a sample or a stock/pluton is mildly peraluminous (A/CNK = 1.0 to 1.1) or strongly peraluminous (A/CNK > 1.2). The A/CNK ratio, the higher the aluminum content and the greater the abundance of aluminum-rich minerals, such as garnet and muscovite which are the more common minerals in a fertile pluton. In short, barren granites will have a low A/CNK ratio, fertile granites will have a moderate A/CNK ratio and rare-element pegmatites will have a high A/CNK (F. W. Breaks, 2006). In this case, a 1.71 average A/CNK for all the samples is considered in the vicinity of a strongly peraluminous fertile pluton.

Table 1 – Relevant analytical results of samples are listed below and include lithium, cesium, rubidium and tantalum.

| Sample ID | Easting NAD83 | Easting NAD83 | Cs (ppm) | Li (ppm) | Rb (ppm) | Ta (ppm) | A/CNK |

|---|---|---|---|---|---|---|---|

| 1290001 | 411164 | 5587355 | 5 | 6 | 283 | 9 | 1.66 |

| 1290002 | 411158 | 5587368 | 14 | 5 | 544 | 28 | 1.41 |

| 1290003 | 411263 | 5588072 | 6 | 5 | 124 | 0 | 1.45 |

| *1290004* | 411184 | 5588531 | 10 | 25 | 498 | 5 | 1.73 |

| 1290005 | 411624 | 5588578 | 119 | 17 | 690 | 2 | 1.55 |

| 1290006 | 411637 | 5588572 | 54 | 10 | 475 | 4 | 1.49 |

| *1290007* | 411569 | 5588296 | 21 | 53 | 725 | 2 | 2.40 |

| 1290008 | 411573 | 5588302 | 2 | 50 | 69 | 1 | 1.79 |

| *1290009* | 411532 | 5588269 | 14 | 37 | 488 | 6 | 1.87 |

| *1290010* | 411465 | 5588235 | 6 | 27 | 174 | 37 | 1.87 |

| 1290011 | 411871 | 5588878 | 1 | 17 | 13 | 0 | 0.84 |

| 1290012 | 411877 | 5588589 | 1 | 11 | 7 | 40 | 1.52 |

| 1290013 | 411879 | 5588591 | 1 | 4 | 3 | 6 | 1.55 |

| 1290014 | 411862 | 5588601 | 17 | 14 | 200 | 87 | 1.67 |

| 1290015 | 412047 | 5588405 | 3 | 12 | 72 | 0 | 1.93 |

| 1290016 | 411562 | 5588233 | 2 | 43 | 58 | 1 | 1.53 |

| 1290017 | 411373 | 5588147 | 1 | 6 | 63 | 0 | 1.49 |

| *1290018* | 411355 | 5588099 | 43 | 175 | 771 | 8 | 2.15 |

| *1290019* | 411340 | 5588109 | 17 | 58 | 537 | 5 | 1.81 |

| *1290020* | 411346 | 5588104 | 11 | 25 | 254 | 17 | 1.50 |

| 1290021 | 411353 | 5588102 | 10 | 96 | 169 | 2 | 1.44 |

| *1290022* | 411338 | 5588116 | 26 | 22 | 514 | 3 | 1.50 |

| 1290023 | 411311 | 5588137 | 18 | 9 | 251 | 1 | 1.83 |

| 1290024 | 411249 | 5587981 | 4 | 8 | 63 | 0 | 1.60 |

| 1290025 | 411254 | 5587991 | 3 | 10 | 46 | 0 | 1.57 |

| 1290026 | 411263 | 5587990 | 3 | 23 | 44 | 1 | 1.57 |

| 1290027 | 411334 | 5587968 | 3 | 7 | 70 | 0 | 1.67 |

| 1290028 | 411373 | 5588033 | 1 | 5 | 34 | 4 | 1.59 |

| 1290029 | 411372 | 5588025 | 8 | 2 | 158 | 3 | 1.66 |

| 1290030 | 411381 | 5588045 | 2 | 4 | 49 | 8 | 1.51 |

| *1290031* | 412012 | 5588075 | 22 | 21 | 297 | 34 | 1.69 |

| 1290032 | 411493 | 5587940 | 1 | 4 | 41 | 6 | 1.67 |

| 1290033 | 411492 | 5587953 | 2 | 3 | 54 | 0 | 1.68 |

| 1290034 | 411447 | 5587983 | 4 | 6 | 100 | 3 | 1.52 |

| 1290035 | 411417 | 5587940 | 1 | 5 | 53 | 0 | 1.44 |

| 1290036 | 411378 | 5587909 | 2 | 6 | 54 | 0 | 1.88 |

| 1290037 | 411260 | 5587934 | 15 | 5 | 269 | 1 | 2.04 |

| *1290038* | 411219 | 5588090 | 21 | 36 | 371 | 4 | 1.94 |

| 1290039 | 411153 | 5588193 | 4 | 9 | 64 | 1 | 1.59 |

| 1290040 | 411083 | 5588153 | 2 | 7 | 37 | 0 | 1.57 |

| 1290041 | 411116 | 5588132 | 8 | 11 | 108 | 3 | 1.43 |

| 1290042 | 411072 | 5588121 | 3 | 9 | 52 | 1 | 1.41 |

| 1290043 | 410971 | 5588064 | 5 | 11 | 59 | 0 | 1.62 |

| 1290044 | 410533 | 5587911 | 8 | 12 | 50 | 0 | 1.89 |

| 1290045 | 410476 | 5587873 | 6 | 17 | 80 | 4 | 1.98 |

| *1290046* | 410413 | 5587915 | 14 | 26 | 159 | 12 | 1.71 |

| 1290047 | 410410 | 5587922 | 5 | 22 | 43 | 1 | 2.22 |

| 1290048 | 410477 | 5587945 | 12 | 74 | 74 | 0 | 1.71 |

| 1290049 | 410477 | 5587940 | 12 | 47 | 93 | 0 | 1.65 |

| 1290050 | 410572 | 5588060 | 3 | 23 | 18 | 0 | 1.65 |

| 1290051 | 410589 | 5588082 | 12 | 8 | 197 | 16 | 1.52 |

| 1290052 | 410582 | 5588092 | 4 | 31 | 56 | 0 | 1.71 |

| 1290053 | 410604 | 5588052 | 11 | 4 | 449 | 2 | 1.56 |

| 1290054 | 410604 | 5588058 | 3 | 24 | 55 | 0 | 1.76 |

| 1290055 | 410694 | 5588121 | 6 | 16 | 52 | 0 | 1.75 |

| 1290056 | 410691 | 5588135 | 7 | 9 | 47 | 0 | 2.00 |

| 1290057 | 410985 | 5588325 | 3 | 23 | 27 | 1 | 1.66 |

| 1290058 | 411020 | 5588340 | 6 | 11 | 86 | 1 | 1.77 |

| *1290059* | 411347 | 5587807 | 32 | 21 | 232 | 2 | 1.77 |

| 1290060 | 411366 | 5587807 | 6 | 21 | 45 | 0 | 1.65 |

| 1290061 | 411386 | 5587847 | 20 | 8 | 49 | 1 | 2.10 |

| 1290062 | 411370 | 5587859 | 12 | 12 | 61 | 1 | 2.17 |

| 1290063 | 411387 | 5587848 | 5 | 8 | 84 | 0 | 2.07 |

| 1290064 | 411251 | 5588502 | 41 | 18 | 1000 | 98 | 1.84 |

| 1290065 | 411259 | 5588501 | 33 | 24 | 943 | 37 | 2.36 |

| 1290066 | 411274 | 5588460 | 39 | 5 | 1640 | >100 | 1.62 |

| 1290067 | 411261 | 5588195 | 48 | 18 | 424 | 20 | 1.91 |

| *1290068* | 411238 | 5588169 | 23 | 24 | 435 | 13 | 1.66 |

| *1290069* | 411237 | 5588170 | 40 | 26 | 517 | 16 | 1.76 |

| 1290070 | 411094 | 5588039 | 3 | 11 | 60 | 1 | 1.68 |

| 1290071 | 411522 | 5587721 | 3 | 6 | 67 | 1 | 1.75 |

| 1290072 | 411505 | 5587581 | 6 | 13 | 68 | 0 | 2.09 |

| 1290073 | 411418 | 5587479 | 2 | 7 | 54 | 0 | 1.92 |

| 1290074 | 411356 | 5587429 | 6 | 11 | 70 | 0 | 1.58 |

| 1290075 | 412481 | 5587212 | 2 | 8 | 62 | 0 | 1.54 |

| 1290076 | 412605 | 5587237 | 4 | 10 | 109 | 1 | 1.26 |

| 1290077 | 412570 | 5587466 | 1 | 6 | 64 | 5 | 1.24 |

| 1290078 | 412946 | 5587194 | 1 | 6 | 45 | 3 | 1.59 |

| 1290079 | 412952 | 5587153 | 2 | 5 | 91 | 4 | 1.67 |

| 1290080 | 412974 | 5587134 | 1 | 4 | 30 | 2 | 1.60 |

| 1290081 | 413001 | 5587105 | 3 | 6 | 97 | 2 | 1.69 |

| 1290082 | 412948 | 5587102 | 4 | 9 | 84 | 1 | 1.52 |

| 1290083 | 412909 | 5587092 | 5 | 2 | 94 | 0 | 1.89 |

| 1290084 | 411716 | 5587300 | 4 | 7 | 95 | 0 | 1.45 |

| 1290085 | 411776 | 5587344 | 3 | 6 | 79 | 0 | 1.70 |

| 1290086 | 411809 | 5587227 | 1 | 5 | 76 | 0 | 1.92 |

| 1290087 | 411881 | 5587152 | 4 | 4 | 94 | 0 | 2.07 |

| 1290088 | 411904 | 5587149 | 4 | 7 | 69 | 0 | 1.66 |

| *1290089* | 411189 | 5588532 | 141 | 223 | 511 | 17 | 1.67 |

| 1290090 | 411163 | 5588545 | 3 | 17 | 32 | 2 | 0.88 |

| *1290091* | 411186 | 5588530 | 21 | 142 | 1240 | 4 | 2.98 |

Annotated samples indicate samples with above average crustal levels for Cs, Li, Rb, and Ta.

Note the above samples are selected rock chip samples. They do necessarily reflect the average grade of the outcrop. There are no known factors that are expected to materially affect the accuracy or reliability of the data referred to above.

Quality Assurance/Quality Control

All samples were submitted to Activation Laboratories in Thunder Bay, Ontario, Canada for whole rock geochemical analysis. This lab is independent of GCOM. The analytical codes used include Ultratrace 6 (ICP-OES – ICP-MS) and 8-peroxide-all elements (Na2O2 digest/ICP-OES).

Mapping station and UTM coordinates (NAD83 UTM 16N) were recorded using a handheld GPS and data such as lithology, texture, mineral content, alteration, and a general rock description for each rock sample taken. Each representative grab sample was taken from an outcrop using a hammer. From there, the sample was placed into a poly sample bag along with a sample tag labeled with a corresponding sample number from a sample tag booklet. Flagging tape was used to mark the sample location on the ground as well as on a nearby tree. Access was derived from North Road along with various historic logging roads.

Filing of Technical Report

The Company has filed an initial technical report (the “Technical Report”) on the Armstrong Project in compliance with NI 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) entitled “National Instrument 43-301 Independent Technical Report, Armstrong Lithium Property, Thunder Bay Mining Division, Ontario Canada” dated December 78, 2023. The Technical Report was completed following the initial exploration program and accordingly includes particulars with respect thereto. A copy of the Technical Report is available under the Company’s profile on SEDAR+ available at www.sedarplus.ca.

Options Granted

The Company is also announcing that it has granted a total of 4,250,000 stock options (“Options”) to various directors, officers, employees and consultants of the Company.

Each Option is exercisable to acquire one common share of the Company (a “Common Share”) for a period of five years at a price of $0.10 per Common Share, with 25% of the Options vesting immediately and 25% vesting every six months following the date of grant over an 18 month period.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Peter Mullens (FAusIMM), Executive Chairman of the Company, who is a “Qualified Person” in accordance with NI 43-101.

Please note that the QP did not review the samples in the field that were included in this report. The rock chip samples were collected by contract prospectors.

About Green Shift Commodities Ltd.

Green Shift Commodities Ltd. is focused on the exploration and development of commodities needed to help decarbonize and meet net-zero goals. The Company is advancing several projects including the Armstrong project in Ontario. Armstrong is adjacent to GT1’s Seymour project which holds a lithium resource. Green Shift is also advancing the Rio Negro Project in Argentina, a district-scale project in an area known to contain hard rock lithium pegmatite occurrences that were first discovered in the 1960s with little exploration since.

For further information, please contact:

Green Shift Commodities Ltd.

Trumbull Fisher

Director and CEO

Email: [email protected]

Tel: (416) 917-5847

Website: www.greenshiftcommodities.com

Twitter: @greenshiftcom

LinkedIn: https://www.linkedin.com/company/greenshiftcommodities/

Forward-Looking Statements

This news release includes certain “forward looking statements”. Forward-looking statements consist of statements that are not purely historical, including statements regarding beliefs, plans, expectations or intensions for the future, and include, but not limited to, statements with respect to: the completion of future exploration work and the potential results of such test work; the future direction of the Company’s strategy; and other activities, events or developments that are expected, anticipated or may occur in the future. These statements are based on assumptions, including that: (i) the ability to achieve positive outcomes from test work; (ii) actual results of exploration, resource goals, metallurgical testing, economic studies and development activities will continue to be positive and proceed as planned, (iii) requisite regulatory and governmental approvals will be received on a timely basis on terms acceptable to Green Shift (iv) economic, political and industry market conditions will be favorable, and (v) financial markets and the market for uranium, battery commodities and rare earth elements will continue to strengthen. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements, including, but not limited to: (1) changes in general economic and financial market conditions, (2) changes in demand and prices for minerals, (3) the Company’s ability to source commercially viable reactivation transactions and / or establish appropriate joint venture partnerships, (4) litigation, regulatory, and legislative developments, dependence on regulatory approvals, and changes in environmental compliance requirements, community support and the political and economic climate, (5) the inherent uncertainties and speculative nature associated with exploration results, resource estimates, potential resource growth, future metallurgical test results, changes in project parameters as plans evolve, (6) competitive developments, (7) availability of future financing, (8) the effects of COVID-19 on the business of the Company, including, without limitation, effects of COVID-19 on capital markets, commodity prices, labor regulations, supply chain disruptions and domestic and international travel restrictions, (9) exploration risks, and other factors beyond the control of Green Shift including those factors set out in the “Risk Factors” in our Management Discussion and Analysis dated May 1, 2023 for the fiscal year ended December 31, 2022 and other public documents available under the Company’s profile on SEDAR+ at www.sedarplus.ca. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Green Shift assumes no obligation to update such information, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.