U3O8 Corp. Announces Conditional Approval for Listing on the TSXV, Provides Corporate Update, and Announces Debt Settlement and C$2 Million Non-Brokered Private Placement

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Toronto, Ontario – July 11, 2022 – U3O8 Corp. (NEX: UWE.H), (“U3O8” or the “Company”) is pleased to announce that it has received conditional approval to list its common shares on the TSX Venture Exchange (“TSXV”) through, among other things:

- Achieving positive working capital.

- Receipt of conditional approval for the Company’s debt settlement plan as described more fully below (the “Debt Settlement”).

- Completion of a National Instrument 43-101 technical report (“Technical Report”) on the Berlin uranium and battery commodity deposit.

- The anticipated closing of a private placement (“Private Placement”) on or around July 29, 2022, to provide funds to advance the Berlin Deposit and for additional working capital as described more fully below.

It is expected that the common shares of the Company (“Common Shares”) will commence trading on the TSXV under the symbol UWE shortly after the closing of the Private Placement.

Approval of the listing on the TSXV is subject to the receipt of all regulatory approvals including the final approval of the TSXV.

Debt Settlement

The Company survived the ten-year bear market in uranium thanks to shareholder support in private placements, salary deferrals and write-offs by senior management, the Company’s board (“Board”) waiving fees, and through a loan for C$1 million made available by the Company’s former Chairman, Dr. Keith Barron. The Board approved the repayment of the loan in cash and the Company repaid the principal on May 10, 2022. The loan was made at an interest rate of 8%, and payment of the accrued interest of approximately C$250,000 is planned to be made shortly.

The Board also approved the payment of salary-related debt to senior management of the Company. In 2015, the CEO agreed to write off C$217,225 in accrued salary. In addition, an amount of C$803,481 was owed to the CEO, CFO and management personnel in Argentina and Colombia, related to salary deferral commencing in 2015. A settlement was reached with these individuals for a 25% discount. The settlement included C$228,671 in cash, the majority of which has already been paid, and C$362,448 in equity in U3O8 Corp., with $212,362 of deferred salary forgiven to facilitate the Company’s application to list its Common Shares on the TSXV. The debt settlement includes the issuance of shares at a price of $0.15 per Common Share. Hence, a total of 2,416,319 Common Shares are planned to be issued in the debt settlement and will increase the number of issued and outstanding shares by 6.3%. All securities issued and issuable pursuant to the Debt Settlement will be subject to a hold period of four months and one day from the Closing Date. Completion of the Debt Settlement is subject to the receipt of all regulatory approvals including the approval of the TSXV.

Working Capital

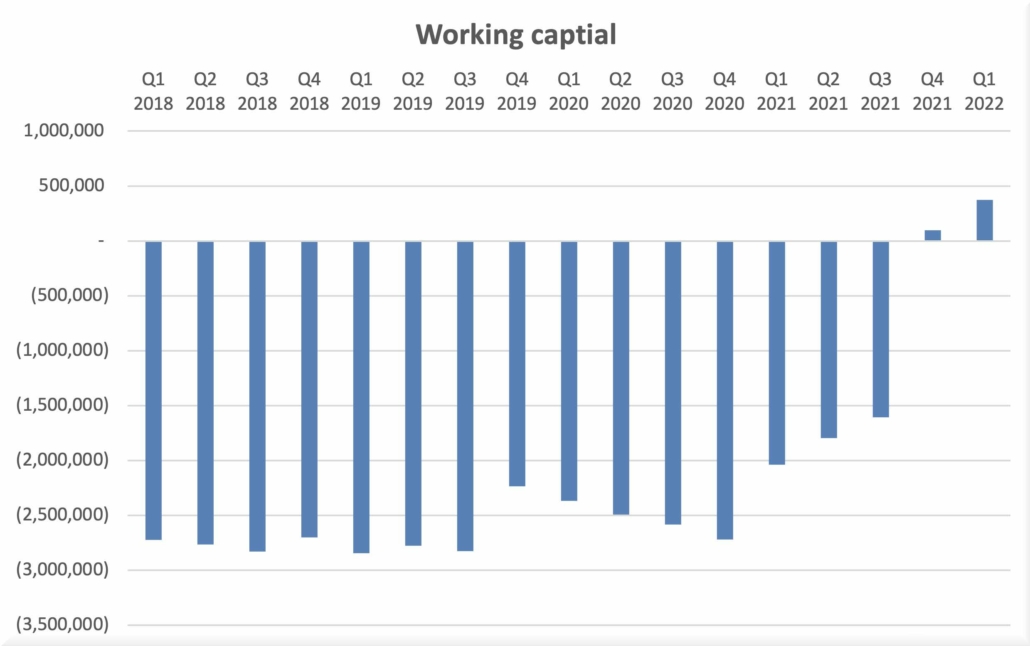

The Corporation’s financial position at March 31, 2022 relative to prior periods, is illustrated in Figure 1, which demonstrates the turn-around that the Company has made to support its application for listing on the TSXV.

Figure 1. U3O8 Corp.’s working capital by quarter in Canadian Dollars.

Investments

The Company owns 1,106,422 common shares in Consolidated Uranium Inc. (“CUR”) and 157,213 common shares in Labrador Uranium Inc. (“LUR”), a company that was spun out by CUR on February 22, 2022, related to the sale of Laguna Salada deposit in Argentina. This CUR shareholding provides U3O8 Corp.’s shareholders continued exposure advancement of the Laguna Salada uranium-vanadium deposit, as well as other uranium deposits in Australia, the USA and Canada. The LUR shareholding provides exposure to uranium-vanadium in Labrador.

Non-Brokered Private Placement

The Board has approved Management to conduct a private placement of 18,181,818 Units (the “Offering”) to raise gross proceeds of C$2 million on the following terms:

- Unit price: C$0.11.

- Each Unit consists of one Common Share of the Corporation and one Common Share purchase warrant (“Warrant”). Each Warrant entitles the holder to purchase one additional Common Share of the Corporation at a price of C$0.15 for a period of three years from the date of issuance, subject to the acceleration clause described below.

- In the event that the closing price of the Common Shares is equal to or greater than C$0.40 for 30 consecutive days on which the TSXV is open for trading, the Company shall have the option to accelerate the expiry of the warrants to 60 calendar days after the 30th day on which the Corporation’s shares traded at or above C$0.40.

- Certain eligible finders who direct investors to participate in the private placement shall be paid a cash fee of 7% of the value of the subscriptions from such investors and shall be issued such number of finders’ warrants (“Finders’ Warrants”) up to 7% of the Units sold to such investors. Finders Warrants shall have the same terms as the Warrants.

- All securities issued and issuable pursuant to the Offering will be subject to a hold period of four months and one day from the Closing Date.

- Closing: the closing of the private placement is expected to be on or about July 29, 2022 and shortly prior to the tier graduation to the TSXV.

- Use of proceeds: to provide additional working capital to reinitiate operations in Colombia to advance the Berlin Deposit and for general corporate purposes.

- Completion of the Offering is subject to the receipt of all regulatory approvals including the approval of the TSXV.

The securities have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Please contact Richard Spencer at the email address given below or at the phone number provided if you have any queries about the placement.

Related Party Transaction

In connection with the Debt Settlement, it is expected that Richard Spencer will acquire 1,100,000 Common Shares and John Ross will acquire 464,393 Common Shares. These are “related party transactions” as such term is defined by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”), requiring the Company, in the absence of exemptions, to obtain a formal valuation for, and minority shareholder approval of, the “related party transactions”. The Company is relying on an exemption from the formal valuation and minority shareholder approval requirements set out in MI 61-101 as the fair market value of the participation in the Debt Settlement by Messrs. Spencer and Ross does not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101.

About U3O8 Corp.

U3O8 Corp. is focused on the development of the Berlin Deposit in Colombia. Apart from uranium for clean, nuclear energy, the Berlin Deposit contains battery commodities including nickel, phosphate and vanadium. Phosphate is a key component of lithium-ion ferro-phosphate (“LFP”) batteries that are being used by BYD, Tesla and a growing list of electric vehicle manufacturers. Nickel is a component of various lithium-ion batteries, while vanadium is the element used in vanadium redox flow batteries. Neodymium, one of the rare earth elements contained within the Berlin Deposit, is a key component of powerful magnets that are used to increase the efficiency of electric motors and in generators in wind turbines.

For further information, please contact:

Richard Spencer, President & CEO, U3O8 Corp., Tel: (647) 292-0225 [email protected]

Forward-Looking Statements

This news release includes certain “forward looking statements” related with the development plans, economic potential and growth targets of U3O8 Corp.’s Berlin Project. Forward-looking statements consist of statements that are not purely historical, including statements regarding beliefs, plans, expectations or intensions for the future, and include, but not limited to, statements with respect to: (a) the completion of a reactivation transaction or successful reactivation of the Berlin Project; (b) the potential for membrane technology to increase the efficiency of metal and phosphate extraction on the Berlin Project, (c) the price and market for uranium, battery commodities and rare earth elements, and (d) the future price of uranium. These statements are based on assumptions, including that: (i) the ability to find a profitable undertaking or successfully conclude a purchase of such an undertaking at all or on terms which are commercially acceptable; (ii) actual results of our exploration, resource goals, metallurgical testing, economic studies and development activities will continue to be positive and proceed as planned, (iii) requisite regulatory and governmental approvals will be received on a timely basis on terms acceptable to U3O8 Corp., (iv) economic, political and industry market conditions will be favourable, and (v) financial markets and the market for uranium, battery commodities and rare earth elements will continue to strengthen. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements, including, but not limited to: (1) changes in general economic and financial market conditions, (2) changes in demand and prices for minerals, (3) the Company’s ability to source commercially viable reactivation transactions and / or establish appropriate joint venture partnerships, (4) litigation, regulatory, and legislative developments, dependence on regulatory approvals, and changes in environmental compliance requirements, community support and the political and economic climate, (5) the inherent uncertainties and speculative nature associated with exploration results, resource estimates, potential resource growth, future metallurgical test results, changes in project parameters as plans evolve, (6) competitive developments, (7) availability of future financing, (8) the effects of COVID-19 on the business of the Company, including, without limitation, effects of COVID-19 on capital markets, commodity prices, labour regulations, supply chain disruptions and domestic and international travel restrictions, (9) exploration risks, and other factors beyond the control of U3O8 Corp. including those factors set out in the “Risk Factors” in our Management Discussion and Analysis dated May 2, 2022 for the fiscal year ended December 31, 2021 available on SEDAR at www.sedar.com. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. U3O8 Corp. assumes no obligation to update such information, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.