U3O8 Corp. Sells the Laguna Salada Project to Focus on the Berlin Uranium and Battery Commodities Deposit

Toronto, Ontario – June 11, 2021 – U3O8 Corp. (NEX: UWE.H), (“U3O8” or the “Company”) announces that International Consolidated Uranium Inc. (“CUR”) has chosen to exercise its option to purchase the Laguna Salada Project in Argentina from U3O8 Corp. The terms of the option agreement (“Option Agreement”) were outlined in U3O8 Corp.’s press release dated December 14, 2020.

The cash component of the purchase will be used to advance U3O8 Corp.’s Berlin Deposit that contains uranium, a suite of battery commodities and rare earth elements. The component of the purchase price to be paid in CUR shares will be held in U3O8 Corp.’s treasury to provide its shareholders with exposure to a broadening portfolio of uranium deposits that CUR has acquired in Australia and Canada.

Consideration for the Laguna Salada Project

A summary of the status and related terms of the Option Agreement are as follows:

- On signing the option agreement on December 14, 2020, CUR paid C$50,000 for U3O8 Corp. to maintain the mineral concessions constituting the Laguna Salada Project in good standing.

- The Option Agreement required that an option fee of C$300,000 be paid on the effective date of the Option Agreement following receipt of conditional approval of the TSX-V. This option fee has two components: C$175,000 is to be paid in cash and C$125,000 in common shares of CUR. Since the 5-Day VWAP to June 9, 2021 is C$2.22, CUR will issue 56,306 common shares to the value of C$125,000.

- CUR agreed to pay an additional C$50,000 in cash to keep the Laguna Salada concessions in good standing.

- On electing to exercise the option to purchase, which CUR has elected to do by notice to U3O8 Corp. dated today, CUR will pay C$1.5 million to U3O8 Corp. through the issuance of 675,675 common shares in CUR. These shares will be held in escrow until the mineral concessions that constitute the Laguna Salada Project have been transferred from U3O8 Corp. to CUR.

- U3O8 Corp. has further upside exposure to the uranium market in that if, within 10 years of the date of the Option Agreement, the spot price of uranium reaches US$50 per pound (“/lb”), CUR would make a payment of C$505,000. If the spot price were to reach US$75/lb, CUR would pay U3O8 Corp. C$758,000 and on reaching US$100/lb, U3O8 Corp. would receive C$1,010,000.

Closing of the acquisition remains subject to satisfaction of certain closing conditions customary for a transaction of this nature. All securities issued in connection with the Option Agreement are subject to final approval of the TSX-V. The shares are subject to a statutory 4 month and one day hold period.

Berlin Deposit

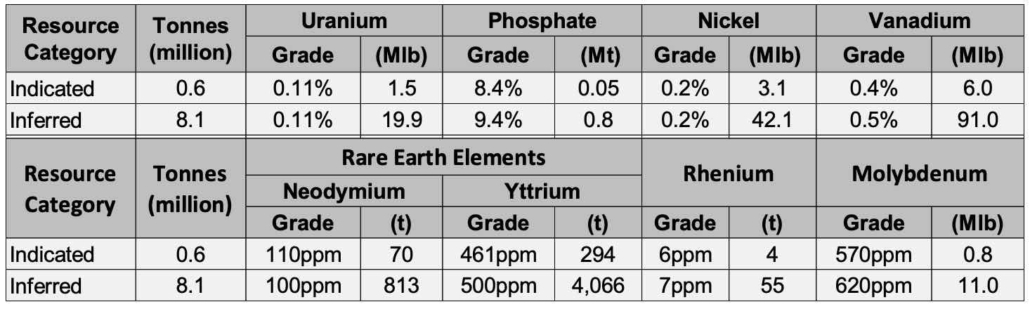

The Berlin Deposit contains uranium, nickel, vanadium, phosphate and rare earth elements in a 3 metre thick sedimentary layer which close-spaced resource drilling, and wider-spaced exploration drilling, has shown to be remarkably consistent in thickness, metal content and grade. This exploration drilling was completed over an area of similar size to the resource area – which highlights the potential for the resource to grow. The current resource estimate is shown in Table 1. Extensive metallurgical test work done on the Deposit was successful in extracting this suite of commodities from the host-rock.

Next Steps on the Berlin Deposit

As announced in the press release of March 29, 2021, work has started to determine the impact that membrane technology may have on reducing operating and capital costs of the Berlin Deposit as modelled in the Preliminary Economic Assessment. The results of the first stage of the three phases of test work outlined in the March 29, 2021 press release will be announced shortly.

Table 1. Resource estimate of the Berlin Deposit estimated in accordance with National Instrument 43-101: (millions of pounds: “Mlbs”, millions of metric tonnes: “Mt”). Data are from Preliminary Economic Assessment of the Berlin Deposit, Colombia, 2013.

Qualified Person

The geological and resource estimate information contained in this news release has been verified and approved by Richard Spencer, Ph.D., BSc (Hons), who is a designated Professional Geoscientist (PGeo) with the Association of Professional Geoscientists of Ontario and as a Chartered Geologist (CGeo) with the Geological Society of London, United Kingdom. Through these designations, Dr. Spencer is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

About U3O8 Corp.

U3O8 Corp. is focused on exploration and development of deposits of uranium and battery commodities in South America. Battery commodities that occur with uranium resources include vanadium, nickel, phosphate and zinc. The Company’s mineral resources estimates were made in accordance with National Instrument 43-101. A preliminary economic assessment (“PEA”) showed positive economics on the project and highlighted areas in which both operating and capital costs could be reduced to enhance the economics of the deposit. Extensive metallurgical test work showed that revenue streams would be dominated by uranium, phosphate, nickel, vanadium and rare earth elements, of which only two were considered in the economic assessment. Rhenium, another high-value, high-tech element, was also not considered in economic assessment. Phosphate is being used in the lithium-ion batteries used by BYD, the giant battery and e-vehicle maker in Chia and is also being used in Teslas produced in China.

A PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

For further information, please contact:

Carolina Diaz at [email protected] or phone (416) 868-1491 or Richard Spencer, President & CEO, U3O8 Corp., Tel: (647) 292-0225 [email protected]

Forward-Looking Statements

This news release includes certain “forward looking statements” related with the development plans, economic potential and growth targets of U3O8 Corp’s projects. Forward-looking statements consist of statements that are not purely historical, including statements regarding beliefs, plans, expectations or intensions for the future, and include, but not limited to, statements with respect to: (a) the completion of a reactivation transaction; (b) the low-cost and near-term development of Laguna Salada, (c) the Laguna Salada and Berlin PEAs, (d) the potential of the Kurupung district in Guyana, (e) impact of the U- pgradeTM process on expected capital and operating expenditures, and (f) the price and market for uranium. These statements are based on assumptions, including that: (i) the ability to find a profitable undertaking or successfully conclude a purchase of such an undertaking at all or on terms which are commercially acceptable; (ii) actual results of our exploration, resource goals, metallurgical testing, economic studies and development activities will continue to be positive and proceed as planned, and assumptions in the Laguna Salada and Berlin PEAs prove to be accurate, (iii) a joint venture will be formed with the provincial petroleum and mining company on the Argentina project, (iv) requisite regulatory and governmental approvals will be received on a timely basis on terms acceptable to U3O8 Corp., (v) economic, political and industry market conditions will be favourable, and (vi) financial markets and the market for uranium will improve for junior resource companies in the short-term. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements, including, but not limited to: (1) changes in general economic and financial market conditions, (2) changes in demand and prices for minerals, (3) the Company’s ability to source commercially viable reactivation transactions and / or establish appropriate joint venture partnerships, (4) litigation, regulatory, and legislative developments, dependence on regulatory approvals, and changes in environmental compliance requirements, community support and the political and economic climate, (5) the inherent uncertainties and speculative nature associated with exploration results, resource estimates, potential resource growth, future metallurgical test results, changes in project parameters as plans evolve, (6) competitive developments, (7) availability of future financing, (8) the effects of COVID-19 on the business of the Company, including, without limitation, effects of COVID-19 on capital markets, commodity prices, labour regulations, supply chain disruptions and domestic and international travel restrictions, (9) exploration risks, and other factors beyond the control of U3O8 Corp. including those factors set out in the “Risk Factors” in our Annual Information Form dated March 27, 2019 for the fiscal year ended December 31, 2018 available on SEDAR at www.sedar.com. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. U3O8 Corp. assumes no obligation to update such information, except as may be required by law. For more information on the above-noted PEAs, refer to the September 18, 2014 technical report titled “Preliminary Economic Assessment of the Laguna Salada Uranium-Vanadium Deposit, Chubut Province, Argentina” and the January 18, 2013 technical report titled “U3O8 Corp. Preliminary Economic Assessment on the Berlin Deposit, Colombia.”

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.